Roth 401k conversion tax calculator

401k IRA Rollover Calculator. Roth IRAs are the only tax-sheltered retirement plans that do not impose RMDs.

Roth Conversion Analysis Software And Optimal Strategy

For instance if you expect your income level to be lower in a particular year but increase again in later years.

. As of January 2006 there is a new type of 401 k contribution. Roth 401 k Conversion Calculator. Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity.

Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. Converting An Ira To Roth After Age 60. You May Like.

This calculator compares two alternatives with equal out of pocket costs to estimate the change in total net-worth at retirement if you convert your per-tax 401 k into an after-tax Roth 401. 2022 Roth Conversion Calculator. The Roth 401 k allows contributions to a 401 k account on an after-tax basis -- with no taxes on qualifying distributions when the money is withdrawn.

For some investors this could prove. Traditional 401 k and your Paycheck. Official Site - Open A Merrill Edge Self-Directed Investing Account Today.

Your income for the tax year will. Once converted Roth IRA plans are not subject to required minimum distributions RMD. Ad Open An Account That Fits Your Retirement Needs With Merrill Edge Self-Directed Investing.

How To Calculate Max 401k Contribution. The Roth Conversion Calculator RCC is designed to help investors understand the key considerations in evaluating the conversion of. Converted plan balance is allowed to grow tax-free and all withdrawals are tax-free as well.

Find Fresh Content Updated Daily For Roth ira conversion tax calculator. Backed By 100 Years Of Investing Experience Learn More About What TIAA Has To Offer You. One big decision is whether or not you should convert your traditional IRA into a Roth IRA.

When planning for retirement there are a number of key decisions to make. Ad Our Conversion Tool Helps You Determine If Converting To A Roth Is Right For You. Say youre in the 22 tax bracket and convert 20000.

Ad Strong Retirement Benefits Help You Attract Retain Talent. Roth 401k Conversion Calculator With the passage of the American Tax Relief Act any 401k plan that allows for Roth contributions will now be eligible to convert existing pre-tax. This calculator can help you make informed decisions about performing a Roth conversion in 2022.

Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. The contribution limits on a Roth 401 k are the same as those for a traditional 401 k. Converting to a Roth IRA may ultimately help you save money on income taxes.

Use this Roth IRA conversion calculator to project the inflation-adjusted value of your Traditional IRA or 401k at retirement versus the inflation-adjusted value of the same funds at retirement. Roth 401 k Conversion Calculator. Roth 401 k Conversion Calculator.

19500 or 26000 in 2021 or 20500 in 2022 with the 6500 catch-up amount. It increases your income and you pay your ordinary tax rate on the conversion. Free withdrawals on contributionsCommon retirement plans such as 401ks and traditional.

Pros of Roth IRA. The information in this tool includes education to help you determine if converting your. Retirement savers who convert pre-tax retirement accounts such as IRAs to.

There are many factors to consider including the amount to convert current tax rate and your age. Roth 401 k contributions allow. This calculator will demonstrate the difference between taking a lump-sum payment from your 401 k and saving it in a tax-deferred account until retirement.

With the passage of the American Tax Relief Act any 401 k plan that allows for Roth contributions will now be eligible to convert existing pre-tax 401 k. This calculator will show the advantage if any of converting your pre-tax 401 k to a Roth 401 k. With the passage of the American Tax Relief Act any 401 k plan that allows for Roth contributions will now be eligible to convert existing pre-tax 401 k.

With the passage of the American Tax Relief Act any. A 401 k can be an effective retirement tool. Roth Conversion Calculator Methodology General Context.

Colorful interactive simply The Best Financial Calculators. Use the tool to compare estimated taxes when you do. With the passage of the American Tax Relief Act any 401 k plan that allows for Roth contributions will now be eligible to convert.

Roth Ira Conversion Calculator Converting An Ira Schwab Roth Ira Conversion Roth Ira Conversion Calculator

The Average 401k Balance By Age Personal Capital

The Bold And Beautiful Roth Conversion Ladder Clipping Chains

A Betr Calculation For The Roth Conversion Equation Vanguard

Roth Ira Conversion 2012 Roth Calculator For Mr Esq Marotta On Money

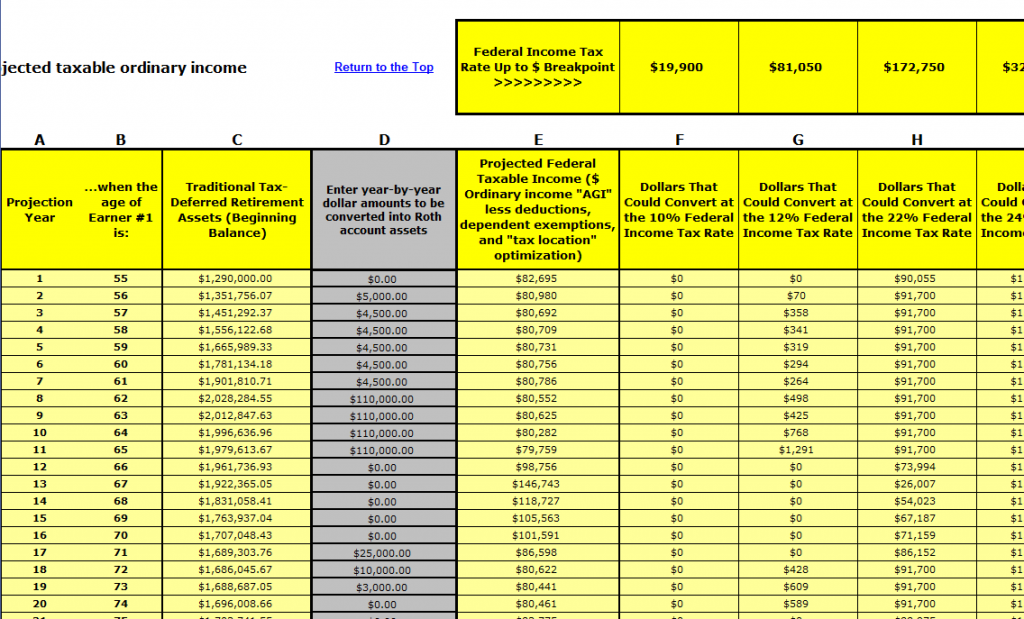

Diy Roth Conversion Engine Template Bogleheads Org

The Most Accurate Roth Conversion Calculator You Ll Find

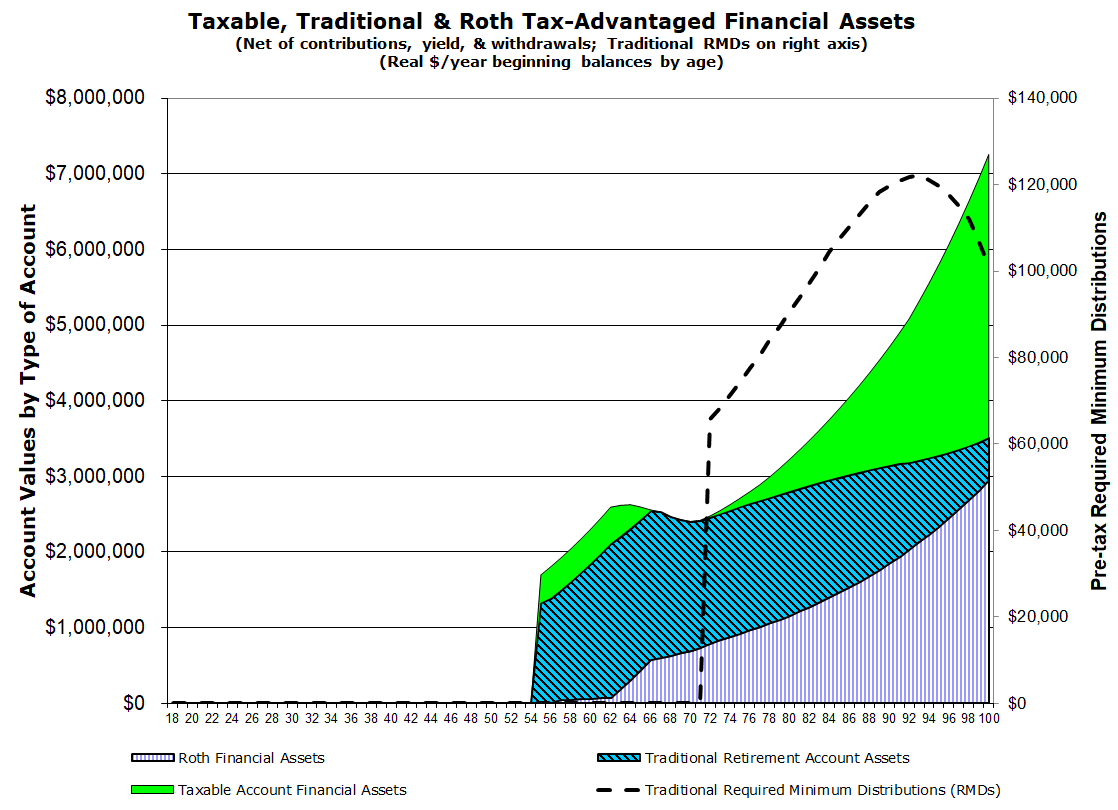

Systematic Partial Roth Conversions Recharacterizations

Canada Rates Interest Retirement Fund Early Retirement Health Savings Account

Roth Ira Conversion Tax Calculator Software

Systematic Partial Roth Conversions Recharacterizations

A Roth Ira Conversion Is Probably A Waste Of Time And Money For Most

The Tax Planning Window And Partial Roth Conversions For 401k Millionaires White Coat Investor

Five Reasons To Consider A Roth Conversion Roth Conversation Traditional Ira

The Most Accurate Roth Conversion Calculator You Ll Find

Roth 401 K In Plan Roth Conversions Morgan Stanley At Work

Roth Conversion Calculator Fidelity Investments